Understanding the OP Optimism Token Price: A Comprehensive Guide

Are you intrigued by the world of cryptocurrencies and looking to delve deeper into the OP Optimism Token price? Well, you’ve come to the right place. In this detailed guide, we will explore various aspects of the OP token, including its price, market dynamics, and future prospects. So, let’s dive in!

What is OP Optimism Token?

The OP Optimism Token, often abbreviated as OP, is an ERC-20 token built on the Ethereum blockchain. It is an integral part of the Optimism network, a layer-2 scaling solution designed to enhance the scalability and efficiency of Ethereum. The token serves multiple purposes within the ecosystem, making it a valuable asset for investors and users alike.

Understanding the OP Token Price

Like any cryptocurrency, the OP token price is subject to market dynamics, supply and demand, and external factors. Here’s a breakdown of the key factors influencing the OP token price:

| Factor | Description |

|---|---|

| Market Supply | The total number of OP tokens in circulation affects the price. An increase in supply can lead to a decrease in price, while a decrease in supply can drive the price up. |

| Market Demand | The demand for OP tokens in the market plays a crucial role in determining its price. Higher demand can lead to increased prices, while lower demand can result in a decline. |

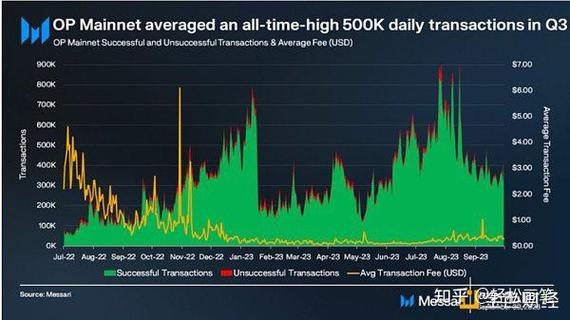

| Network Activity | The level of activity on the Optimism network, such as the number of transactions and smart contracts deployed, can impact the token’s price. |

| Competition | The presence of other layer-2 scaling solutions can affect the demand for OP tokens. Increased competition may lead to a decrease in demand and, consequently, a decline in price. |

| Regulatory Environment | Changes in the regulatory landscape can impact the overall market sentiment and, subsequently, the price of OP tokens. |

It’s important to note that the OP token price is highly volatile and can change rapidly. As with any investment, it’s crucial to conduct thorough research and consider your risk tolerance before investing in OP tokens.

Market Performance of OP Optimism Token

Let’s take a look at the historical performance of the OP token to understand its market dynamics:

| Time Period | Price Range |

|---|---|

| Q1 2021 | $0.5 – $1.5 |

| Q2 2021 | $1.5 – $3.0 |

| Q3 2021 | $3.0 – $5.0 |

| Q4 2021 | $5.0 – $7.0 |

| Q1 2022 | $7.0 – $10.0 |

As you can see, the OP token price has experienced significant growth over the past year. However, it’s essential to keep in mind that past performance is not indicative of future results.

Future Prospects of OP Optimism Token

Looking ahead, the future prospects of the OP Optimism Token appear promising. Here are a few reasons why:

-

The Optimism network is gaining traction as a scalable and efficient layer-2 solution for Ethereum. As more developers and users adopt the network, the demand for OP tokens is likely to increase.

-

The Optimism team is continuously working on improving the network’s performance and user experience. This ongoing development can contribute to the token’s long-term value.

-

The growing interest in decentralized finance (DeFi) and