Understanding Co-op Cheques 2023 Payment: A Comprehensive Guide

Are you planning to receive or issue Co-op cheques in 2023? If so, you’ve come to the right place. This article will delve into the intricacies of Co-op cheques, their payment process, and everything you need to know to navigate this financial transaction smoothly.

What are Co-op Cheques?

Co-op cheques, also known as cooperative cheques, are a type of payment instrument used by cooperatives and member-owned organizations. These cheques are issued by the cooperative society to its members for various transactions, such as dividends, refunds, or other financial obligations.

Types of Co-op Cheques

There are different types of Co-op cheques, each serving a specific purpose:

| Type of Co-op Cheque | Description |

|---|---|

| Dividend Cheques | Issued to members as a share of the cooperative’s profits. |

| Refund Cheques | Provided to members when they return goods or services. |

| Payment Cheques | Used to settle financial obligations between the cooperative and its members. |

How to Issue a Co-op Cheque

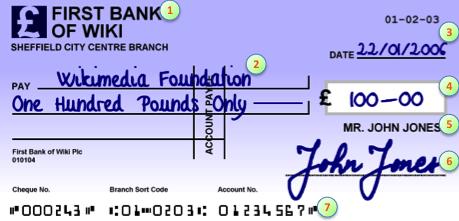

Issuing a Co-op cheque is a straightforward process. Here’s a step-by-step guide:

- Obtain a pre-numbered Co-op chequebook from your cooperative society.

- Fill in the necessary details, such as the payee’s name, amount, and date.

- Sign the cheque in the presence of a witness, if required by your cooperative society.

- Deliver the cheque to the payee or deposit it in their bank account.

How to Deposit a Co-op Cheque

Depositing a Co-op cheque is similar to depositing any other type of cheque. Here’s what you need to do:

- Endorse the back of the cheque with your signature and account number.

- Take the cheque to your bank or deposit it online through your banking app.

- Wait for the bank to process the cheque and credit your account with the funds.

Co-op Cheque Payment Process

The payment process for Co-op cheques involves several steps:

- The cooperative society issues the cheque to the member.

- The member deposits the cheque in their bank or cashes it at a bank branch.

- The bank processes the cheque and credits the member’s account with the funds.

- The cooperative society’s bank debits the cooperative’s account for the amount paid.

Co-op Cheque Security

Security is a crucial aspect of Co-op cheques. Here are some measures to ensure the safety of your Co-op cheques:

- Keep your chequebook in a secure place.

- Do not sign your cheques until you are ready to issue them.

- Endorse your cheques immediately after cashing or depositing them.

- Report any lost or stolen cheques to your cooperative society and bank immediately.

Co-op Cheque Cancellation

In case you need to cancel a Co-op cheque, follow these steps:

- Write “VOID” across the cheque in large, legible letters.

- Sign the cheque as you normally would.

- Destroy the cancelled cheque to prevent misuse.

Co-op Cheque Replacement

If your Co-op cheque is lost, stolen, or destroyed, you can request a replacement. Here’s how:

- Contact your cooperative society and inform them of the lost or stolen cheque.

- Provide the necessary details, such as the cheque number, date, and amount.

- Pay any applicable fees for the replacement cheque.

- Collect the new cheque from your cooperative society